47% of New Buyers Surprised by How Affordable Homes Are Today Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly...

Mortgages

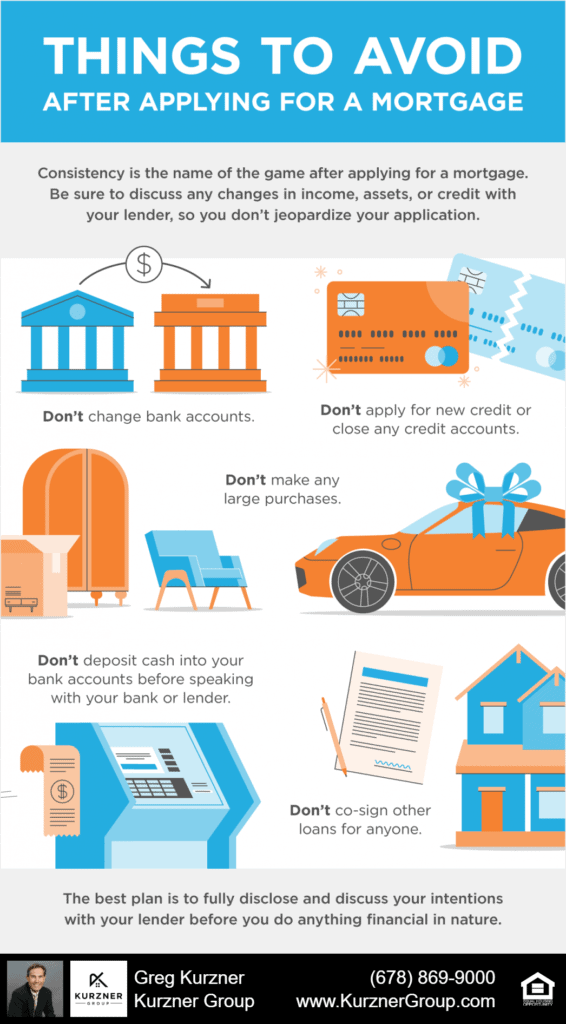

Some Highlights There are a few key things to make sure you avoid after applying for a mortgage to help make sure you still qualify for your loan at the closing table.Along the way, be sure to discuss any changes in income, assets, or credit with your lender, so you don’t unintentionally jeopardize your application.The best plan is to fully disclose your intentions with your lender before you...

How long have you lived in your current home? If it’s been a while, you may be thinking about moving. According to the latest Profile of Home Buyers and Sellers by the National Association of Realtors (NAR), in 2019, homeowners were living in their homes for an average of 10 years. That’s a long time to be in one place, considering the average length of time homeowners used to stay...

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and...

The health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result, many people have been laid off or furloughed. Naturally, that would lead many to believe we might see a rush of foreclosures like we saw in 2008. The market today, however, is very different...

Some Highlights Mortgage rates hit another all-time low, falling below 3% this week.If you’re ready to buy a home, now is a great time to truly get more for your money at this historic moment.Let’s connect today to determine your best next steps toward homeownership. Download a Buyer or Seller Guide Below... Home Sellers Guide Sell your home with confidence....

Over the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the history of the survey, which dates back to 1971 (See graph below): What does this mean for buyers? This is huge for homebuyers. Those currently taking advantage of the...

Everyone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase. There are three main factors that go into determining how affordable homes are for...

According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well. There’s a very positive outlook on interest rates...

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below):Let’s break down why these are a...

![Mortgage Rates Fall Below 3% [INFOGRAPHIC]](https://www.kurznergroup.com/wp-content/uploads/2021/05/20200717-infographic-745x1024.png)