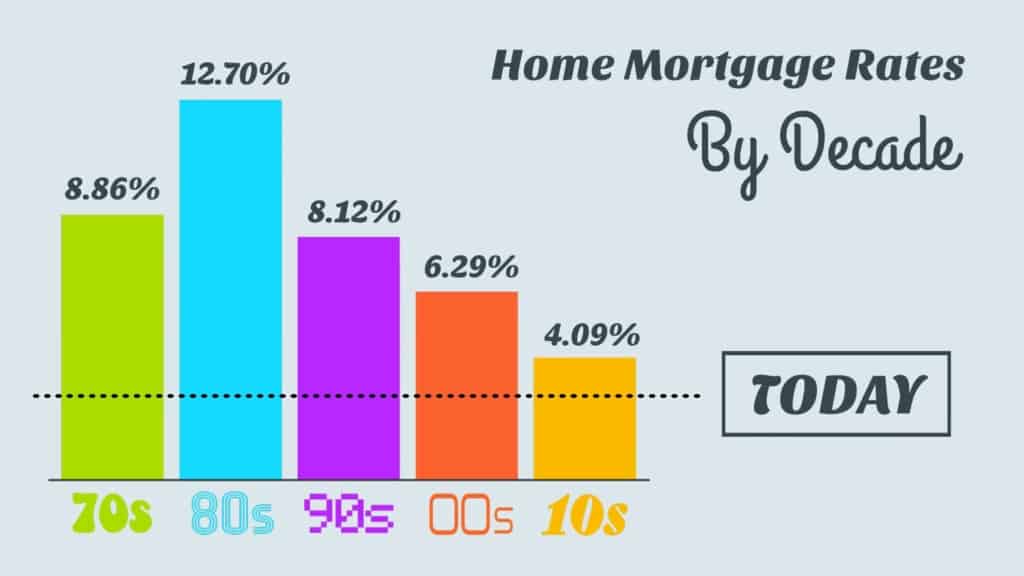

In today’s real estate market, mortgage interest rates are near record lows. If you’ve been in your current home for several years and haven’t refinanced lately, there’s a good chance you have a mortgage with an interest rate higher than today’s average. Here are some options you should consider if you want to take advantage of today’s current low rates before they rise. Sell and Move Up (or...

Mortgages

Forbearance programs allow homeowners to temporarily suspend or reduce their monthly mortgage payments. These programs are offered by the lender or the company that administers the loan. Forbearance does not reduce or forgive the debt owed to the lender. Instead, it gives the borrower an option to defer payments and in many cases to avoid foreclosure by working proactively with the lender to manage the...

You may have heard some tales about how much money you need to put down as a down payment on a house. You probably got some bad information! And that's good news because the amount you heard is probably much more than you actually need to buy a home. Watch this below to bust the House Down Payment Myth. https://youtu.be/KAKiPa-32hs Kurzner Group is ready to help you understand how much you need...

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon? Mortgage Rates Will Likely Increase, but Remain Low Many experts are projecting a rise...

Some Highlights Today’s sellers’ market provides unique challenges—and benefits—for buyers. Current low interest rates won’t last forever, and home prices are forecast to rise. If you’re a homebuyer, hang in there. Homeownership improves your quality of life, and the long-term benefits outweigh the short-term challenges. Kurzner Group is ready to help you purchase a new home or sell...

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer. Being intentional and competitive are...

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is...

Applying for a mortgage is easy. Anyone can apply. Getting approved for and closing on that mortgage require that you meet certain requirements and DON'T DO certain things. These are some of the things you should avoid doing after you apply for a mortgage. https://youtu.be/6ATG9ED4SbE Kurzner Group is a real estate agent in Atlanta. We can help you buy or sell homes, and we can help you avoid...

Timing is everything, they say. This is especially true of the historically low mortgage rates we are seeing during 2021. Rates haven't been this low in over five decades. A low mortgage rate makes homes more affordable because the interest you pay is reduced by a significant amount, sometimes as much as several hundred dollars per month. We may never see rates this low again. If you are thinking...

The level of equity homeowners have is at an all-time high. According to the U.S. Census, over 38% of owner-occupied homes are owned free and clear, meaning they don’t have a mortgage. Those with a mortgage are seeing their equity skyrocket too. Every time real estate values increase, homeowners get a dollar-for-dollar gain in their home equity. According to the first-quarter 2021 U.S. Home Equity...

![Homebuyers: Hang in There [INFOGRAPHIC]](https://www.kurznergroup.com/wp-content/uploads/2021/06/20210625-blog-infographic-482x1024.png)