Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might encounter. And to do that, turn to trusted real estate professionals. […]

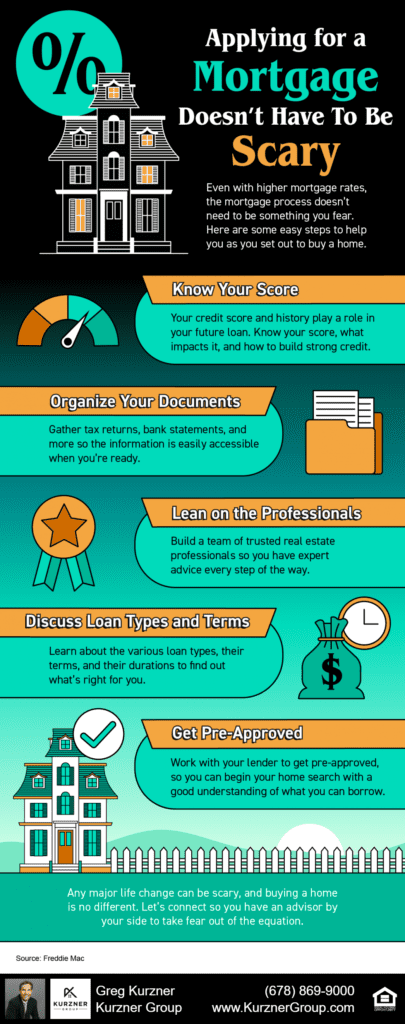

Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC]

Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong credit. When you’re ready, lean on the pros and connect with a lender so you […]

Millennials Are Still a Driving Force of Today’s Buyer Demand

If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. While the millennial generation has been dubbed the renter generation, that namesake may not be […]

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s […]

What Happens to Housing when There’s a Recession?

Since the 2008 housing bubble burst, the word recession strikes a stronger emotional chord than it ever did before. And while there’s some debate around whether we’re officially in a recession right now, the good news is experts say a recession today would likely be mild and the economy would rebound quickly. As the 2022 […]

Pre-Approval Is a Critical First Step on Your Homebuying Journey

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months ago, getting a mortgage pre-approval can be a game changer. Here’s why. What Is Pre-Approval? To better understand why […]

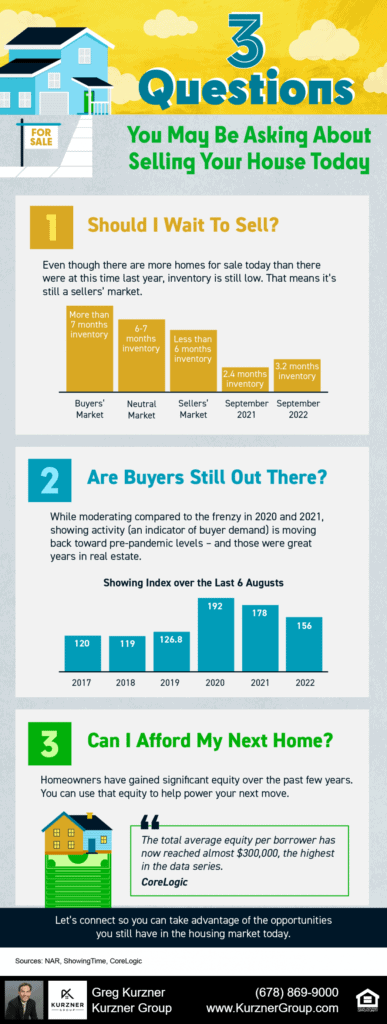

3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC]

Some Highlights If you’re planning to sell your house this year, you likely have questions about what the shift in the housing market means for your home sale. You might be wondering: Should I wait to sell? Are buyers still out there? And can I afford to buy my next home? Let’s connect so you […]

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely […]

Should You Still Buy a Home with the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession. You’re likely feeling the impact in your day-to-day life as you watch the cost […]

The Latest on Supply and Demand in Housing

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point. The graph below helps tell the story of just how different things are today. This year, […]