While this isn’t the frenzied market we saw during the ‘unicorn’ years, homes that are priced right are still selling quickly and seeing multiple offers right now. That’s because the number of homes for sale is still so low. Data from the National Association of Realtors (NAR) shows 76% of homes sold within a month and the average saw 3.5 offers in June. To set yourself up to see advantages like...

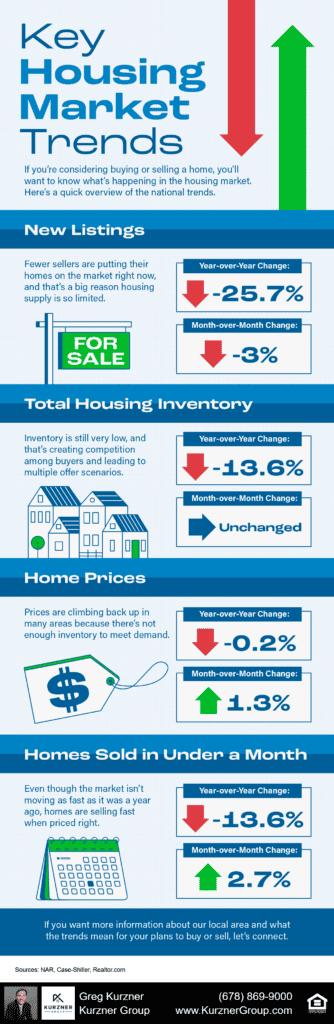

Some Highlights If you’re considering buying or selling a home, you’ll want to know what’s happening in the housing market. Housing inventory is still very low, prices are climbing back up, and homes are selling fast when priced right. Connect with Kurzner Group if you want more information about your local area and what the trends mean for your plans to buy or...

Even though the housing market is no longer experiencing the frenzy that was so characteristic of the last couple of years, it doesn’t mean today’s market is at a standstill. In actuality, buyer traffic is still strong today. The ShowingTime Showing Index is a measure of how much buyers are touring homes. The graph below uses that index to illustrate buyer activity trends over time to help put today...

While the wild ride that was the ‘unicorn’ years of housing is behind us, today’s market is still competitive in many areas because the supply of homes for sale is still low. If you’re looking to buy a home this season, know that the peak frenzy of bidding wars is in the rearview mirror, but you may still come up against some multiple-offer scenarios. Here are a few things to consider to help...

Investing in real estate can be a lucrative venture, but it often requires substantial capital upfront. Unless you have enough cash to cover an entire property purchase, you'll need to find a lending source or sources to help finance your investments. In fact, very few real estate investors pay all cash for investment real estate. Borrowing money for real estate is the norm, and it gives you leverage to...

If you’re thinking of buying a home or selling a home, one of the biggest questions you have right now is probably: what’s happening with home prices? And it’s no surprise you don’t have the clarity you need on that topic. Part of the issue is how headlines are talking about prices. They’re basing their negative news by comparing current stats to the last few years. But you can’t compare this...

If you've been keeping up with the news lately, you've probably come across headlines talking about the increase in foreclosures in today’s housing market. This may have left you with some uncertainty, especially if you're considering buying a home. It’s important to understand the context of these reports to know the truth about what’s happening today. According to a recent report from ATTOM, a...

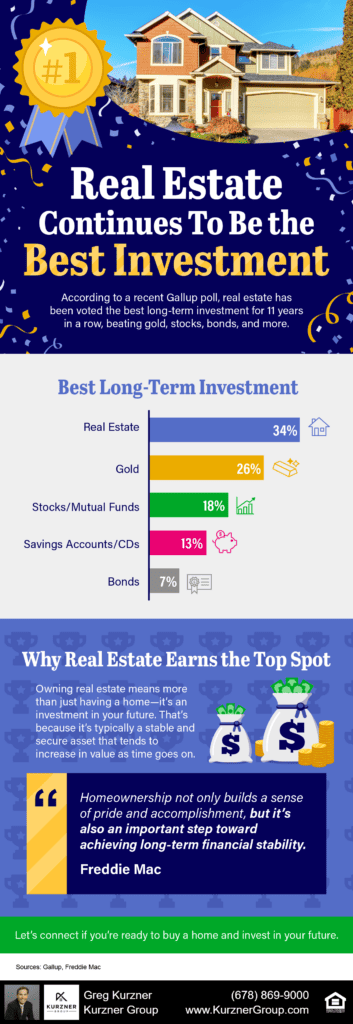

Some Highlights According to a recent Gallup poll, real estate has been voted the best long-term investment for 11 years in a row, beating gold, stocks, bonds, and more. Owning real estate means more than just having a home—it’s an investment in your future. That’s because it’s typically a stable and secure asset that tends to increase in value as time goes on. Connect with a local real estate...

You may have heard some people say it’s better to rent than buy a home right now. But, even today, there are lots of good reasons to become a homeowner. One of them is that owning a home is typically viewed as a good long-term investment that helps your net worth grow over time. Homeownership Builds Wealth Regardless of Income Level You may be surprised to learn homeowners across various income levels...

If you’re following mortgage rates because you know they impact your borrowing costs, you may be wondering what the future holds for them. Unfortunately, there’s no easy way to answer that question because mortgage rates are notoriously hard to forecast. But, there’s one thing that’s historically a good indicator of what’ll happen with rates, and that’s the relationship between the 30-Year...