The 2008 housing crash is still fresh in the memories of Atlantans and people all across the country. Housing prices took a nose dive, builders and developers went out of business, and homeowners who needed to sell were not able to find buyers who would pay what they needed. Many homeowners found themselves owing more on their home than it was worth.

As the Atlanta and nationwide real estate market has exploded in the last 15 months, some people have asked “Are we in another housing bubble and headed for a crash like 2008?”

The simple answer is: no.

The tightening of mortgage lending requirements has gone a long way to making sure that home buyers were not getting in over their heads. Unlike 2008 when lenders made loans to people who could not afford them, today the lending is much more conservative, meaning that even if the economy turns sour, most homeowners will still be able to make their payments.

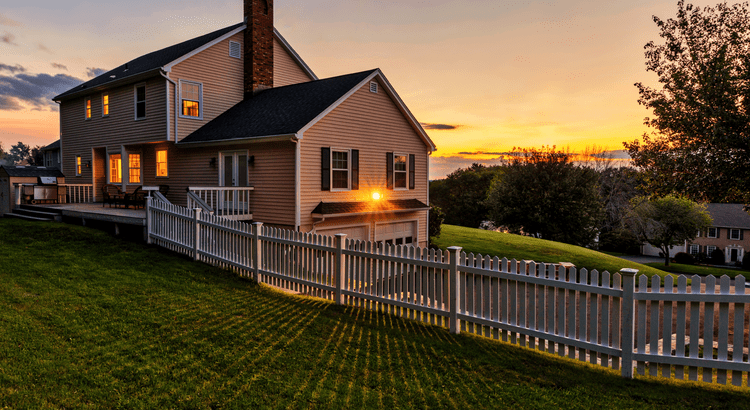

Another factor that is different today than 2008 is the housing supply. Today there aren’t enough houses to meet demand. Back in 2008, there were too many houses, which ultimately depressed prices.

Also, hurting the finances of so many in 2008 were the number of homeowners who refinanced their homes and took equity, or cash, out. This put homeowners on the hook for even higher loan amounts. Today, homeowners have more equity safely “stored” in their homes, meaning they don’t owe the lenders more than they can afford.

Today, the Atlanta real estate market outlook is much rosier than in 2008.

If you would like to explore buying a house in Atlanta or selling your Atlanta home, just connect with us today and let’s see if we are a good fit to help you achieve your real estate goals.